University of Denver Daniels College of Business Executive MBA Cohort 67

Issue Identification

The three key decisions Netflix is faced with coming to terms with at this point in their history are:

- Licensing its proprietary movie and media recommendation engine to 3rd party providers, while maintaining its existing DVD rental service as one of many service offerings featuring the Netflix recommendation engine. (Shih, Kaufman, & Spinola, 2007)

- Launch its own VOD service, and integrate streaming media capabilities in with the existing Netflix DVD rental service. This would let consumers use either service somewhat interchangeably, and require customer to pay for both, despite their own usage.(Shih, Kaufman, & Spinola, 2007)

- Build a VOD service as a completely separate product. This would allow consumers to choose which service they use and only pay for that service, but would create a significant division within the company, and a dilution of their resources. (Shih, Kaufman, & Spinola, 2007)

Foundation for Recommendations

Core recommendations for Netflix in this case is primarily:

- Stay the course of building out VOD product, and enhance future offerings with HD content, enhanced metadata, more sophisticated planning and research tools, and access on mobile, embedded, and other third part devices.

- Integrate VOD offerings in with existing DVD offerings to preserve existing customer base. This is based on analysis of the six paths, with a particular emphasis on the product scope, as well as emotional connection.

- Slowly transition to separated service offerings for VOD and DVD, but both under the same “Netflix” branding.

- Keep recommendation engine integrated into all Netflix products, focus resources on developing more advanced recommendations. Don’t license out recommendation engine to third parties.

- Maintain “Blue Ocean”(Mauborgne & Kim, 2005) of separation by continuing to innovate in media delivery pipeline, deep learning to enhance recommendation engine, as well as slowly enter into studio industry. This recommendation stems from analysis of escalating product delivery costs, which will continue to balloon with the existing, “old school” DVD delivery product.

Closing

It’s clear that Netflix has been, and will continue to be an innovator in the movie and TV delivery industry, and is a quick-emerging leader in the recommendation, customer segmentation, and content delivery industries as well. In this critical point in the pathway of Netflix, they have the opportunity to continue innovating in the areas where they’re already strong – DVD delivery, building VOD, and recommendation engines. However, they also have a ripe opportunity for enhancing their vertical integration, and stepping into new industries – namely studio development, media delivery, deep learning, and psychographic segmentation and optimization.

Their current moat is fairly wide, however they face an impending competition from Blockbuster, and other potential VOD networks. Additionally, they face regulatory and network capacity hurdles to overcome before their VOD network can truly flourish unfettered.

Works Cited

Jenkins, H. W. (2016, April 1). Netflix’s Lesson in Net Neutrality Karma. Retrieved September 14, 2016, from The Wall Street Journal: http://www.wsj.com/articles/netflixs-lesson-in-net-neutrality-karma-1459550381

Kotler, P. (2016). Marketing Management (Vol. 15). Essex, England: Pearson Education Limited.

Mauborgne, R., & Kim, C. (2005). Blue Ocean Strategy. Boston: Harvard Business Review.

Porter, M. (2010). Porter’s Five Forces. (The Internet Center For Management and Business Administration, Inc. ) Retrieved 07 20, 2016, from Quick MA: http://www.quickmba.com/strategy/porter.shtml

Shih, W., Kaufman, S., & Spinola, D. (2007). Netflix. Boston: Harvard Business School Publishing.

Appendix

Appendix – Porter’s Five Forces Analysis (Porter, 2010)

- Bargaining power of suppliers

- In this case, suppliers represent a diverse set of technology and media companies.

- First, media companies who own the rights to movies and tv content must license the content to Netflix. Since content licensing rules are vastly different between DVD/physical media and online streaming or downloading, a significant amount of variability could exist as Netflix aims to efficiently license the content it provides to consumers. Additionally, Netflix faces a significant amount of uncertainty – the market for online media licensing is just emerging, and it’s likely that many rules may change quickly.

- Additionally, suppliers include technology companies – in the case of Netflix, this is mainly ISPs, which deliver Netflix VOD Content to consumers. If Netflix is to be successful, it needs to ensure that its content can be reliably and quickly delivered over a pipeline that 3rd parties control. Securing this transport will involve both technology innovations for Netflix, as well as service level targets and general support from ISPs. Already today, we’re seeing major issues with ISP’s restricting their pipelines, and the ever-growing “net neutrality” debate.(Jenkins, 2016)

- Threat of substitute products or services

- Since Netflix is entering into a “virtual” business with its VOD product, it exposes itself to an almost-nonexistent physical barrier to competitors. In this respect, it would seem that they’re repositioning themselves squarely into a quick to emerge “Red Ocean” of competitive products. (Mauborgne & Kim, 2005)

- However, by integrating their robust recommendation engine, securing top notch and exclusive licensing deals with studios, and being first-to-market with a continuously innovative and compelling product, there is indeed a chance for Netflix to maintain their Blue Ocean, and genuinely carve out a niche for themselves in our rapidly changing media and technology environment.

- Buyers bargaining power of channels and end users

- During the period when Netflix was in a DVD rental business, the primary competitor was Blockbuster – a video rental chain which required customers to travel to a physical store. While this model is easy to use, convenient, and compelling for last minute shoppers, it failed to address surge and inventory constraints, didn’t serve all markets, and was slow to respond to changing sociological nuances.

- The Netflix model struck down many of these barriers. However, in its innovation, it also created many more potential pitfalls, including opening itself up to competitors, easier to replicate technology developments, and more vendors and suppliers in the game, who could exert an increasing bargaining power.

- Barriers to entry

- Barrier to entry are significant for Netflix to break into both the industry of providing their recommendation engine to 3rd parties, as well as to create a separate or integrated VOD market.

- Barriers include content licensing, bandwidth allocation, provider partnerships, studio partnerships, IP protection, product maintenance, and achieving a critical mass of consumers.

- Rivalry among existing competitors

- At this time, the main rivalry comes from competitor Blockbuster. However, with a mature strategy focused on the technological and marketing superiorities of Netflix’s VOD solution, immediate rivalry can be minimized.

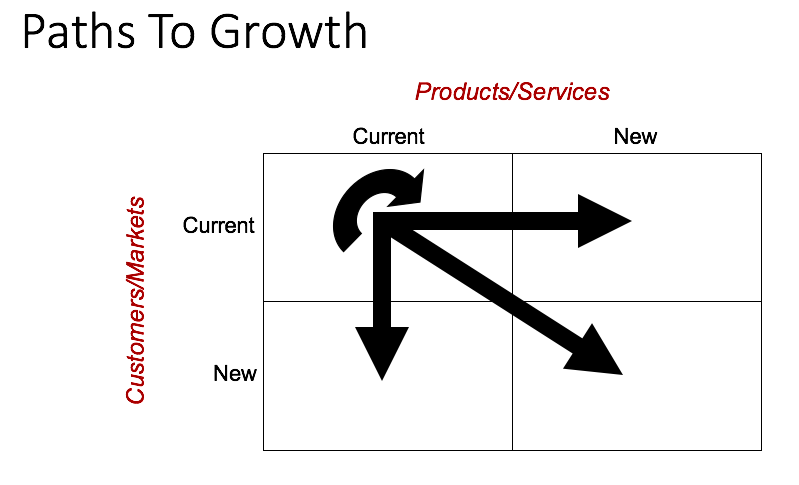

Appendix – Paths to Growth

- Current Customers, Current Products

- In order for Netflix to maintain a consistent growth with its current customers and current products, it’s going to have to massively expand the number and quality of warehouses for stocking DVD’s, as well as will have to find a way to edge out competitors. The way I see it, the only way this could work would be a massive increase in quality of its recommendation engine. However, even if that takes places, I can see their “Blue Ocean” creeping out from under them.

- Current Customers, New Products

- Their current customers are poised to become their new customers, with a massive rollout of new products aimed at the next generation of media consumption – online, on demand, all the time. The most logical course of action for Netflix in this case may be to continue innovating in new products, continue offer its original products, and gradually turn its existing customers into new-product customers, while simultaneously generating products for an entirely new breed of tech-savvy customers.

- New Customers, Current Products

- New customers simply won’t flock to Netflix’s existing line of products in the numbers that they would need to maintain a viable business. Netflix must innovate to stay on top.

- New Customers, New Products

- Clearly, this is the way to go for Netflix – bring both their recommendation engine as well as VOD services to the forefront of their product offering, attract the new generation of customers, and continue to innovate.

Appendix – Four Actions Framework (Mauborgne & Kim, 2005)

The Four Actions Framework helps evaluate key factors used in defining a company’s optimize value curve, ultimately focusing on a goal of a newly defined and efficiently focused curve.

- Raise

- Netflix must raise their VOD delivery technology and recommendation engine intelligence significantly above the industry average. This means allowing customers to start watching content faster, in better quality, and at the most appropriate time.

- Reduce

- Reduction of focus on the DVD delivery business may allow competitors to close in, however this industry will be in decline anyway, and it’s not strictly necessary to continue to sink money and focus into bolstering this fading industry.

- Create

- Netflix should create a more robust content delivery network, and more engaging viewing experience that’s head and shoulders above what anybody else in the industry is offering. Factors that could contribute to a truly groundbreaking viewing experience include enhanced metadata, viewing recommendations, collaborative viewing, and mobile device viewing.

- Eliminate

- Eventually, Netflix should eliminate their DVD rental business, and get rid of physical media entirely. Maintaining warehouse, sorting, and delivery systems is costly and inefficient, and will not be the way to move into the future.

Appendix – Six Path Framework (Mauborgne & Kim, 2005)

Netflix clearly has a number of opportunities to transcend a number of categories of the six paths framework to plant them squarely in a number of Blue Oceans:

- Industry

- Clearly, Netflix is going after industries that don’t yet fully exist with both their recommendation engine as well as their VOD service. On the surface, both of these areas seemingly present as somewhat vast “Blue Oceans”. However, upon further inspection, it’s obvious that both are easily replicated on a basic technological level. In order to continue to keep its ocean blue, and preserve its “economic moat”, Netflix must continue innovating in the intelligence of its recommendation engine, and ease of delivery of its VOD product, as well as continuously expanding its media offering. Another eminently valuable step for Netflix will be to put its media delivery might into building its own production studio, thereby sidestepping media licensing issues, controlling its own content, and distributing as it sees fit.

- Netflix does have rivals, but by continuing to focus on innovating in new directions, rather than on beating competition, the blue ocean will remain wide and clear.

- Strategic Group

- I believe that Netflix’s role within its strategic group is somewhat complicated. This is certainly an area which commands an enhanced level of communication, collaboration, deal making, and strategy in order for Netflix to remain on top. Strategic partners for Netflix will overwhelmingly be internet service providers, networks, and media studios. In the initial phase of Netflix’s drive towards a successful VOD product, they must strike deals with all of these partners. However, as their business matures, they’ll be able to look across that pool as they begin to create their own media studios and protected delivery pipelines.

- In support of building its recommendation engine, Netflix can immediately partner with deep learning and neural network vendors such as AWS and IBM Watson, until it’s at a level where it can move artificial intelligence and deep computing in-house for a holistic, value adding technology buildout.

- Buyer Group

- In this case, I think the prudent thing for Netflix to do would be to slowly shift its existing buyer group from its existing service offering to its new service offering of VOD. There will certainly be a large decrease in “traditional” subscribers. However, a successful transition will also result in opening up Netflix to an increasingly large and relevant new buyer group. It’s this new group which will grow to many times the size of the “traditional” buyer group, and allow Netflix to remain profitable far into the future. Additionally, Netflix can help bridge the gap by improving its recommendation engine.

- Scope of product offering

- This is an area which Netflix should stay focused in, and not disrupt their current blue ocean by trying to change scopes. In this case, I feel like there’s enough of a blue ocean already in place that Netflix can continue to refine and solidify its existing product offering, without necessarily differentiating into additional product scopes.

- Functional-emotional orientation

- Media consumption brings people together, and sets people apart. It’s this emotionally-driven consumer behavior that Netflix will certainly benefit from innovating with. In this case, their recommendation engine seems like it would be an excellent candidate for additional emotional and social applications, such as allowing collaborative selections, demographic and situation-specific recommendations, and peer to peer recommendations.

- Time

- Sure, at the present moment, Netflix is highly dependent on the timing of the film and television industry, as well as on the delivery efficiencies of ISP’s and other providers. However, in order to maintain its blue ocean of time value, a future strategy of controlling its own media properties will be key. By producing the media as well as distributing it, Netflix can get close to complete vertical integration of its service offerings, and thereby be able to more completely control the timing of delivery of its content.

Appendix – Netflix Financial Statements

Based on a brief analysis, it’s apparent that Netflix fulfillment cost is ballooning out of control. Since DVD rentals require the use of warehouses, human labor, shipping fees, and material fees, the more subscribers Netflix acquires, the more expensive it will be to continue to send DVDs. Although content delivery via the internet (VOD model) certainly has delivery fees associated with each subscriber, those costs are kept in check to a much greater degree. The enhanced efficiency of digital delivery means that only server farms are needed, instead of massive DVD warehouses. Since digital infrastructure is easily outsourced, it’s not even strictly necessary for Netflix to build or maintain their own server farms – allowing Netflix’s business to shift into existing solely in the virtual realm.

It’s ultimately recommended that Netfix continue the march towards VOD delivery of its content, which will be instrumental in keeping fulfillment costs in check, maximizing profits.

Endnote – For general interest, in January of 2008, I wrote a quick blog post covering the launch and eventual decline of potential Netflix competitor Joost. https://www.jeffreydonenfeld.com/blog/2008/01/joost-doomed/